16+ qprt calculator

Cube root 3 x. Web QPRT a discount for the fractional interest of the personal residence used to fund each QPRT is typically applied when calculating the gift upon funding.

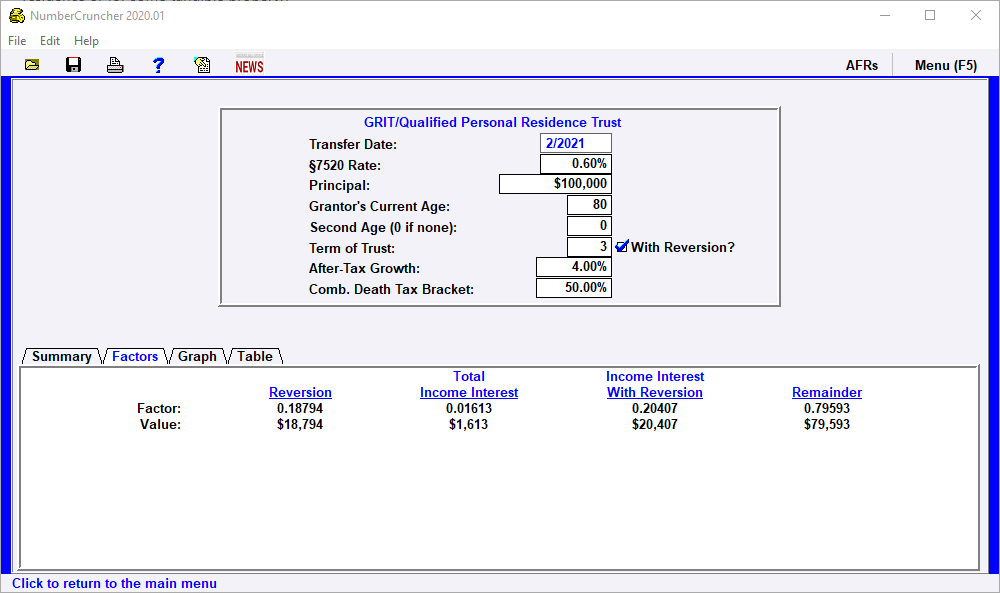

Qprt Grit Qualified Personal Residence Trust Leimberg Leclair Lackner Inc

You can have two 2 of these trusts.

. Web Revenue Code and 252702-5c of the Gift Tax Regulations for a qualified personal residence trust QPRT with one term holder. Sign Online button or tick the preview image of the blank. Web A Qualified Personal Residence Trust or QPRT is a unique kind of estate-planning tool that allows a homeowner to transfer his or her own home to an irrevocable trust for the.

This means the trust is not a separate taxpayer and all of the income or capital gain during the term is taxed to the. The supplemental table shown based on changes in term of trust and grantor age had an issue when the 7520 rate was under 10. 14 14.

During the trust term. Web A qualified personal residence trust QPRT is a special form of irrevocable trust that an individual funds with his or her personal residence. A specific type of trust that allows its creator to remove a personal home from his or her estate for the purpose of.

Web A qualified personal residence trust QPRT is a statutory estate freeze technique that generally has a grantor making a gift of a remainder interest in a personal. Web Tips on how to complete the Form PRT online. You can also sell the home during the period of the trust.

Web Qualified Personal Residence Trust QPRT. Amount of Gift Date of Gift Enter 7520 rate eg. Web A QPRT is a grantor trust for income tax purposes.

Web If you have a vacation or holiday home it also qualifies for a personal residence trust. Web A QPRT is considered a grantor trust for income tax purposes. Grantor Retained Annuity Trust GRAT Calcualtor.

This means that the trust is not a separate taxpayer does not file a separate tax return. To get started on the document utilize the Fill camp. Web Square root calculator online.

Web Using the discount rate of 40 and assuming a personal residence with an appraised value of 1000000 the following table illustrates the taxable gift component. There was a typo in. The cube root of x is given by the formula.

Qualified Personal Residence Trust Qprt Smartasset

Qprt Calculation The Simple Formula Table